Examples of contra accounts include purchases discounts or purchases returns and allowances accounts. A contra account is meant to be opposite from the general ledger because it offsets the balance in their related account and appears in the financial statements. The accountant removes the balance to another account at the end of the year.Ĭompanies make any necessary adjustments from purchasing goods to a general ledger contra account. A temporary account begins each year with a zero balance. Instead, they debit the temporary account purchases.

PERIODIC INVENTORY METHOD UPDATE

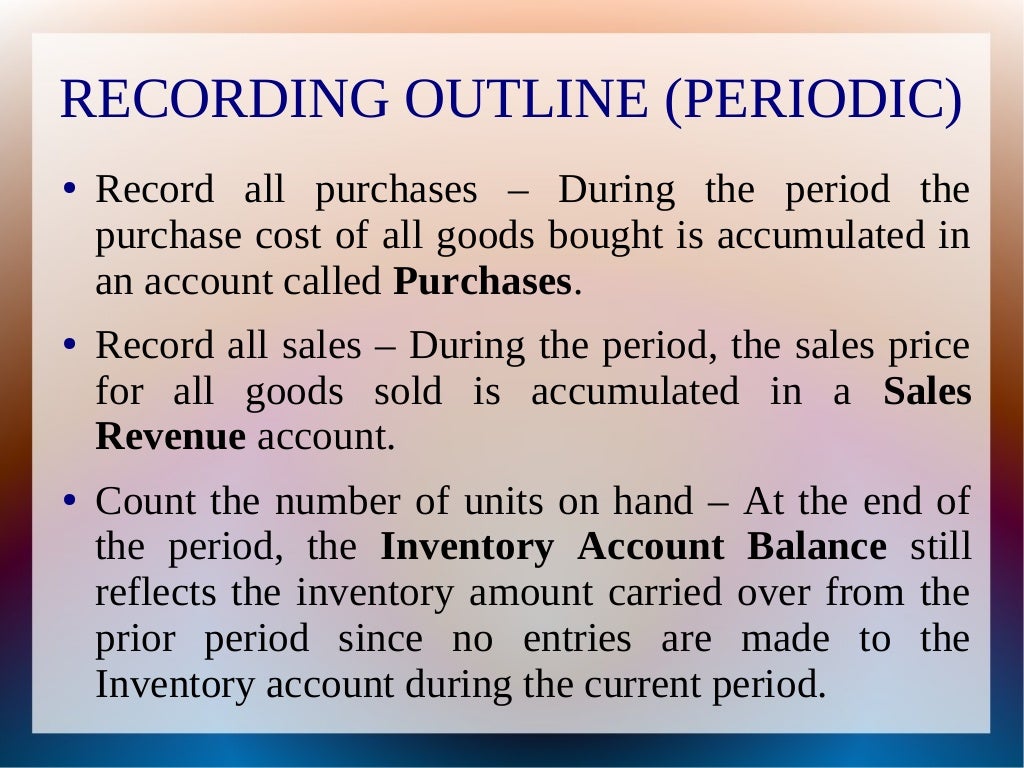

Accountants do not update the general ledger account inventory when their company purchases goods to be resold. Organisations use estimates for mid-year markers, such as monthly and quarterly reports. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock. Under a periodic review inventory system, the accounting practices are different than with a perpetual review system.

Companies then apply the balance to the beginning of the new period. Businesses physically count their products at the end of the period and use the information to balance their general ledger. Periodic inventory is an accounting stock valuation practice that’s performed at specified intervals.

0 kommentar(er)

0 kommentar(er)