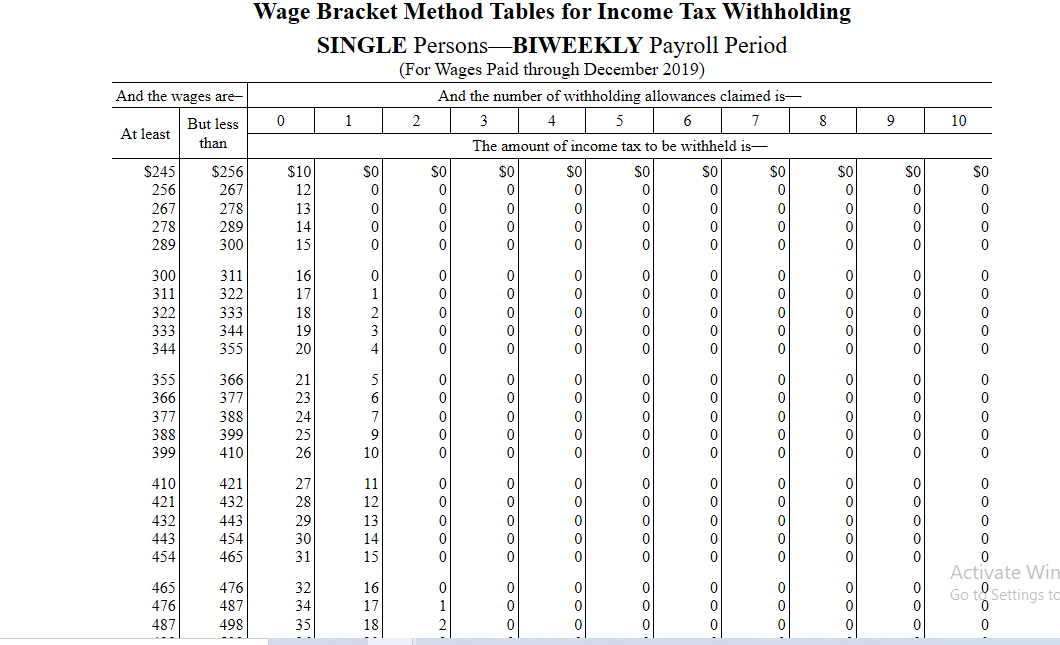

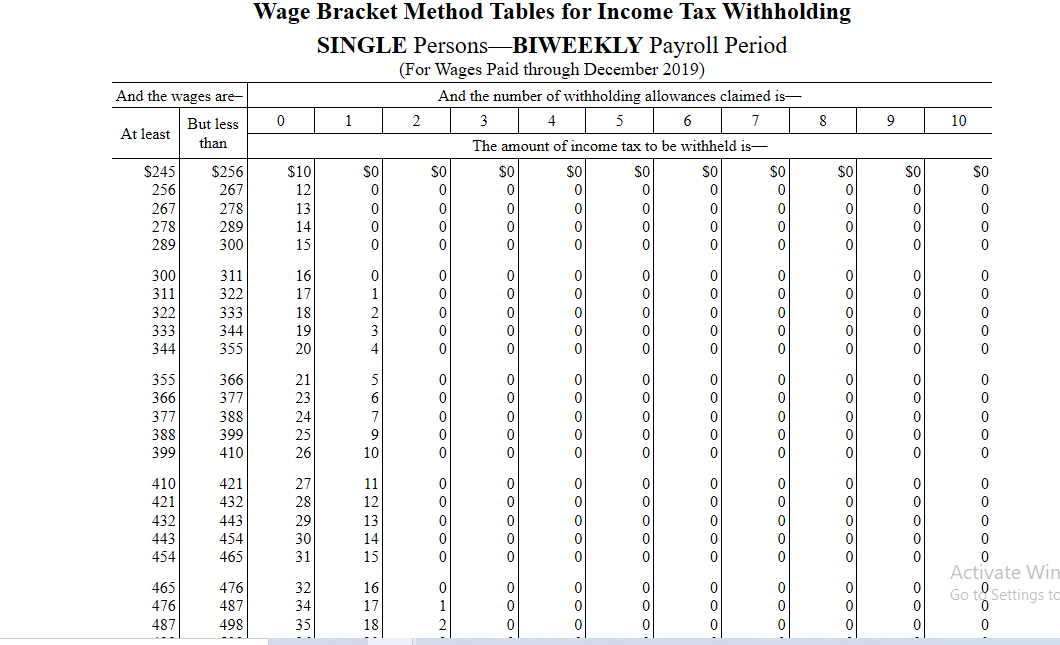

The annual amount per exemption has increased from $4,900 to $5,000.The Single and Married withholding tables have changed.

The Single and Married standard deduction tables have changed. The annual exemption per allowances claimed has increased from $4,300 to $4,450. The annual standard deduction has increased from $2,690 to $2,770. The standard deduction amount for employees claiming two or more withholding allowances has increased from $5,240 to $5,450. The standard deduction amount for employees claiming zero or one withholding allowance has increased from $2,130 to $2,210. The annual exemption amount for the basic allowances claimed for taxpayer, spouse, and other dependents has increased from $2,375 to $2,425. The Standard Deduction for employees who claim Married Filing Separate or Married Filing Joint Where Both Spouses Work has changed from $3,000 to $3,550. The Standard Deduction for employees who claim Single or Head of Household has changed from $4,600 to $5,400. The Standard Deduction for employees who claim Married Filing Joint Where Only One Spouse Works has changed from $6,000 to $7,100. The annual personal exemption credit has increased from $136.40 to $141.90. The Single, Married, and Head of Household withholding tables have changed. The standard deduction for Married with 2 or more Exemptions and Head of Household has increased from $9,202 to $9,606. The standard deduction for Married with 0 or 1 Exemption and Single is increased from $4,601 to $4,803. The low exemption amount for Married with 2 or more Exemptions and Head of Household has increased from $30,534 to $31,831. The low-income exemption amount for Married with 2 or more Exemptions and Single has increased from $15,267 to $31,831.

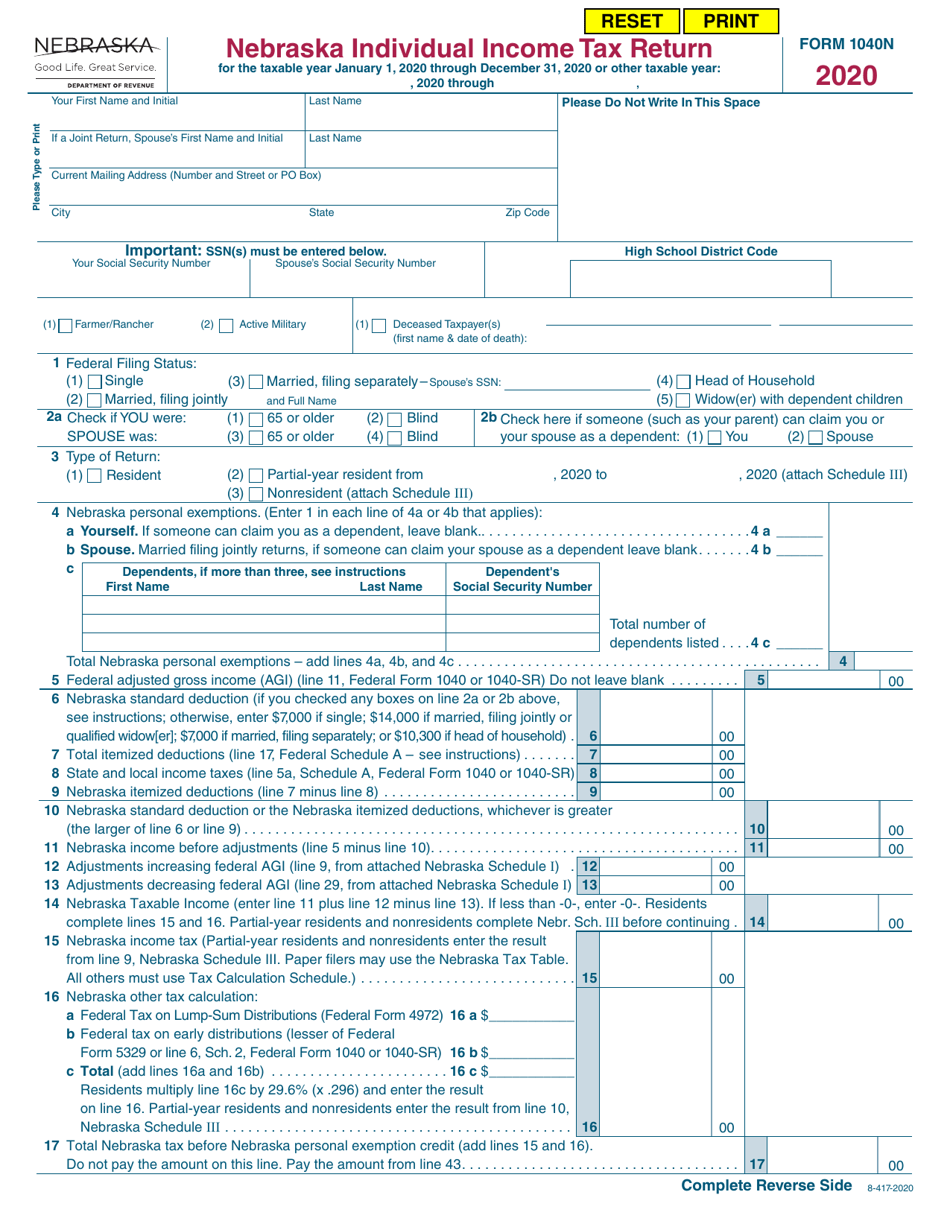

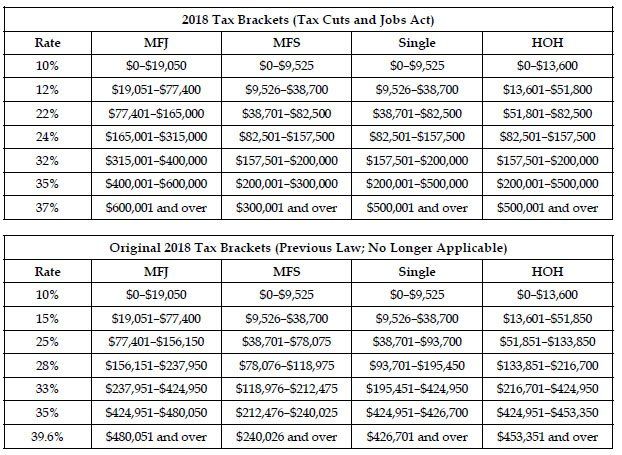

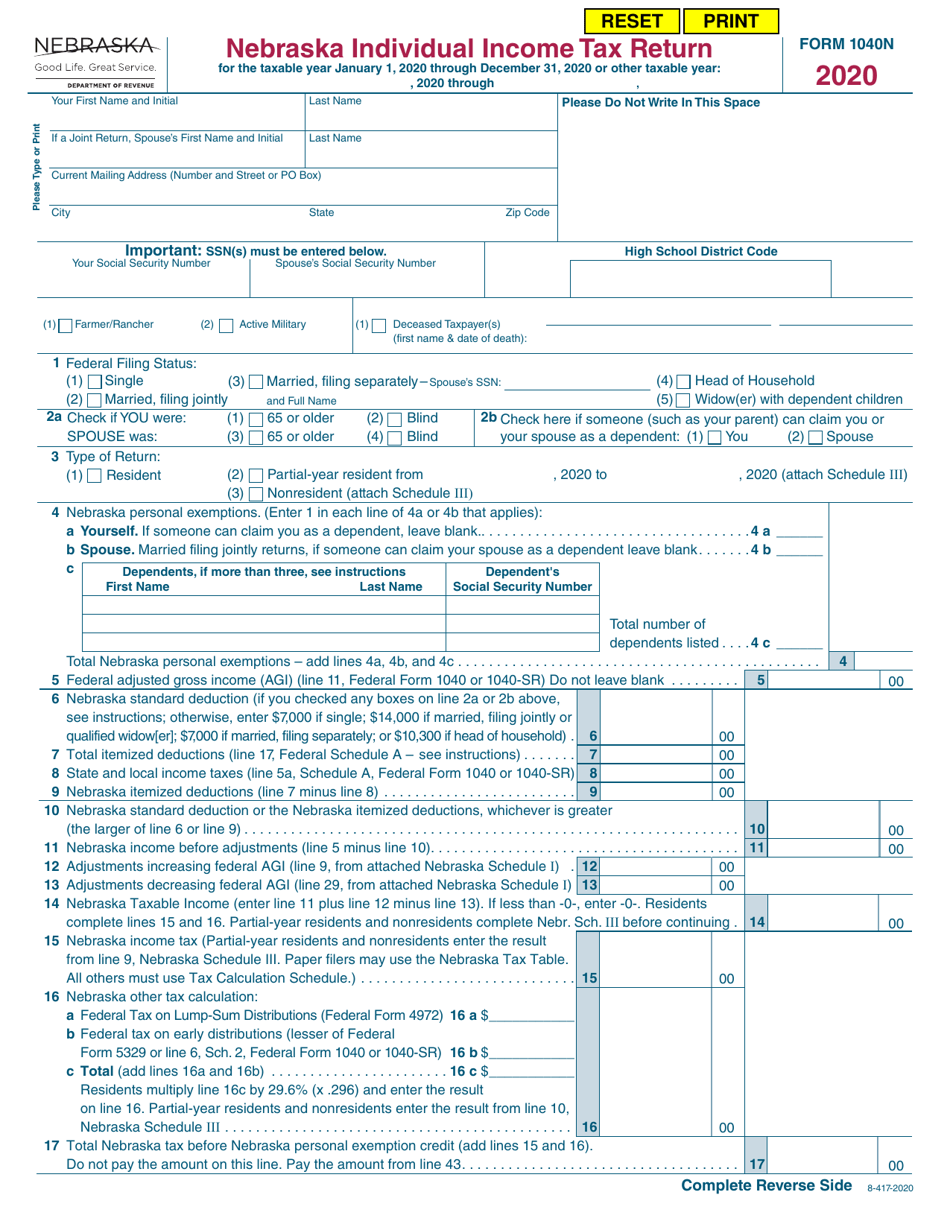

The Single and Married standard deduction tables have changed. The annual exemption per allowances claimed has increased from $4,300 to $4,450. The annual standard deduction has increased from $2,690 to $2,770. The standard deduction amount for employees claiming two or more withholding allowances has increased from $5,240 to $5,450. The standard deduction amount for employees claiming zero or one withholding allowance has increased from $2,130 to $2,210. The annual exemption amount for the basic allowances claimed for taxpayer, spouse, and other dependents has increased from $2,375 to $2,425. The Standard Deduction for employees who claim Married Filing Separate or Married Filing Joint Where Both Spouses Work has changed from $3,000 to $3,550. The Standard Deduction for employees who claim Single or Head of Household has changed from $4,600 to $5,400. The Standard Deduction for employees who claim Married Filing Joint Where Only One Spouse Works has changed from $6,000 to $7,100. The annual personal exemption credit has increased from $136.40 to $141.90. The Single, Married, and Head of Household withholding tables have changed. The standard deduction for Married with 2 or more Exemptions and Head of Household has increased from $9,202 to $9,606. The standard deduction for Married with 0 or 1 Exemption and Single is increased from $4,601 to $4,803. The low exemption amount for Married with 2 or more Exemptions and Head of Household has increased from $30,534 to $31,831. The low-income exemption amount for Married with 2 or more Exemptions and Single has increased from $15,267 to $31,831. NEBRASKA TAX BRACKETS 2022 UPDATE

If this limit changes, another Tax Update will be issued.

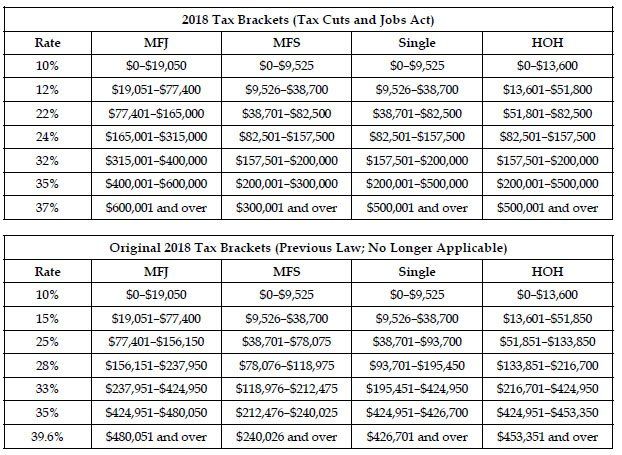

The catch-up contribution limit for Puerto Rico-Only Plans and Dual-qualified Plans will remain $1,500. federal government employees will remain $6,500. The catch-up contribution limit for Puerto Rico plans that cover U.S. federal employees has increased from $19,500 to $20,500. The pre-tax contribution limit for U.S. The standard and high-income tax tables for all marital statuses have changed. For withholding based on a 2020 Form W-4, the annual amount to add to a nonresident alien's taxable wages prior to calculating withholding has changed from $12,550 to $12,950. For withholding based on a pre-2020 Form W-4, the annual amount to add to a nonresident alien's taxable wages prior to calculating withholding has changed from $8,250 to $8,650. The catch-up contribution for employees who will be age 50 or over in 2022 will remain $6,500. Federal 401 (k) Wage Limits - The 401(k) maximum exclusion limit has increased from $19,500 to $20,500. There is no limit on Medicare wages and the Social Security and Medicare tax rates remain unchanged. Federal Social Security (OASDI) Wage Base – The wage base has increased from $142,800 to $147,000.

As a result, employees may see a change in their tax withholdings.

The following tax changes were implemented in PP 2022-01. Please share this information with all impacted employees.

0 kommentar(er)

0 kommentar(er)